|

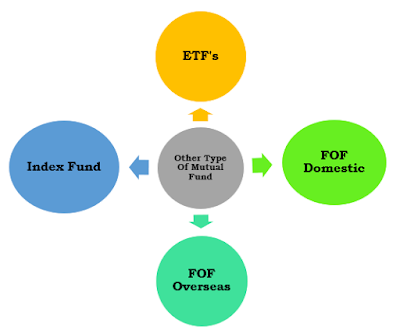

| Types of Others Mutual Fund |

1. ETF’s – ETF or an exchange Traded Fund is an investment fund

traded on stock exchanges, much like stocks. An ETF holds assets such as

stocks, commodities, or bonds and generally operates with an arbitrage

mechanism designed to keep it trading close to its net asset value, although

deviations can occasionally occur.

Example:

1. Quantum Gold Fund

Returns – 1Y – 36%, 3Y – 17%, 5Y – 11.3%

Category Average

- 1Y – 42.5%, 3Y – 15.9%, 5Y – 10.5%

2. Nippon India ETF Long Term Gilt

Dividend

Returns – 1Y – 12.2%,

3Y – 8%, 5Y – NA

Category Average

- 1Y – 13.0%, 3Y – 7.7%, 5Y – 9.1%

Tax Implications

Returns are taxed at 15%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 10% on returns of Rs 1 lakh+ in a financial year.

(Data Taken from Groww App)

Read more here...

2. FOF Domestic – FOF or Fund of Fund for Domestic is a Mutual Fund which utilizes its pool of resources to invest in various other kinds of mutual funds available in the market. Alternatively, investment in hedge funds can also be made via this Mutual Fund.

Fund

of funds MF's have portfolios of varying degree of risks,

depending upon the main aim of the manager. If the primary target of the

portfolio manager is to earn the highest yields possible, then mutual funds

having higher NAV will be targeted, even though it is associated with a higher

degree of risk. However, if the primary aim is stability, low-risk instruments

will be acquired using the pool of financial resources obtained.

These mutual funds are used to invest in domestic, as per the discretion of the asset management company. This increases the diversification of the fund of funds.

The essential characteristic of such Mutual Funds is that they are maintained by highly trained professional portfolio managers. This ensures accurate market predictions to a certain extent, minimizing the chances of incurring a loss.

Example:

1. IDFC All Seasons Bond Fund Direct

Growth

Returns – 1Y – 12.9%,

3Y – 8.9%, 5Y – 9.0%

Category Average

- 1Y – 7.6%, 3Y – 5.5%, 5Y – 6.6%

2. ICICI Prudential Debt Management Fund (FOF) Direct Plan Growth

Returns – 1Y – 9.7%,

3Y – 7.9%, 5Y – 9.5%

Category Average

- 1Y – 9.9%, 3Y – 5.9%, 5Y – 9.5%

Tax Implications

Returns are taxed as per your Income Tax slab, if sold before 3 years. Negligible Tax (20% with indexation benefit) post 3 years.

| FOF Domestic Fund |

3. FOF Overseas – FOF or Fund of Fund for

Overseas is a Mutual Fund which utilizes its pool of resources to

invest in various other kinds of mutual funds available in the market.

Alternatively, investment in hedge funds can also be made via this Mutual Fund.

Fund of funds MFs have portfolios of varying degree of risks, depending

upon the main aim of the manager. If the primary target of the portfolio

manager is to earn the highest yields possible, then mutual funds having higher

NAV will be targeted, even though it is associated with a higher degree of

risk. However, if the primary aim is stability, low-risk instruments will be

acquired using the pool of financial resources obtained.

These mutual funds are used to invest in international

funds, as per the discretion of the asset management company. This increases

the diversification of the fund

of funds.

The essential characteristic of such Mutual Funds is that

they are maintained by highly trained professional portfolio managers. This

ensures accurate market predictions to a certain extent, minimizing the chances

of incurring a loss.

Read More on FOF Fund here...

Example:

1. PGIM India Global Equity Opportunities

Fund Direct Growth

Returns – 1Y – 40.5%,

3Y – 26.0%, 5Y – 11.0%

Category Average

- 1Y – 16.3%, 3Y – 9.3%, 5Y – 6.1%

2. Franklin India Feeder Franklin US

Opportunities Direct Fund Growth

Returns – 1Y – 30.5%,

3Y – 23.3%, 5Y – 15.6%

Even Motilal Oswal Nasdaq 100 Gave a good return which only consists of Top Nasdaq 100 Companies Focused in technology.

Category Average - 1Y – 16.3%, 3Y – 9.3%, 5Y – 6.1%

Tax Implications

Returns are taxed as per your Income Tax slab, if sold before 3 years. Negligible Tax (20% with indexation benefit) post 3 years.

|

| Fund of Fund Overseas |

4. Index Fund – Index fund are generally considered ideal core

portfolio holdings which holds stocks which represents a particular Index of

any economy. Legendary investor Warren Buffett has recommended index funds as a

haven for savings for the later years of life. Rather than picking out

individual stocks for investment, he has said, it makes more sense for the

average investor to buy all of the S&P 500 companies at the low cost

an index fund offers. Index Funds are considered safest if you trust your

economy. A Nation’s Economy is usually developing and growing so therefore investing

in an index fund is not a bad choice these funds gives you an exposure in

countries top performing companies which are a part of that particular Index.

In India some index are like Nifty 50

a collection of Top 50 companies of India and Sensex which consists of only 30

top companies.

| Index Fund Nifty 50 & Sensex Fund |

- Index funds have lower expenses and fees than

actively managed funds.

- Index funds follow a passive investment

strategy.

- Index funds seek to match the risk and return of the market, on the theory that in the long-term, the market will outperform any single investment.

- An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index.

Example:

1. Nippon India Index Fund Sensex

Plan Direct Growth

Returns – 1Y – -10.8%,

3Y – 4.7%, 5Y – 5.3%

Category Average

- 1Y – -16.9%, 3Y – 0.9%, 5Y – 7.0%

2. SBI Nifty Index Direct Plan Growth

Returns – 1Y – -12.7%,

3Y – 3.1%, 5Y – 7.9%

Category Average

- 1Y – -16.9%, 3Y – 0.9%, 5Y – 7.0%

Returns are quite low due to Covid-19 market correction.

Tax Implications

Returns are taxed at 15%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 10% on returns of Rs 1 lakh+ in a financial year.

Note: Mutual Funds scheme returns are as on date 26, June 2020 whose data Taken from Groww App. There can be no assurance or guarantee that the investment objective of the scheme will be achieved.

Other Readings: What are Mutual Funds and types of Mutual funds... What are Solution Oriented Mutual funds and their types... What are Equity Mutual funds and their types... |

IMPORTANT LINKS

Open your Trading and de-mat account with Zedrodha India's number one broker

Open your Investment and algo account with Upstock

Open your Mutual fund investment account with the number 1 App Groww

______________________________________

4 Comments

Very informative 😍

ReplyDeleteIt's an informative article! Thank you for sharing the article with us. Keep sharing.

ReplyDeleteGreat points there, thanks!

ReplyDeleteGreat content

ReplyDelete